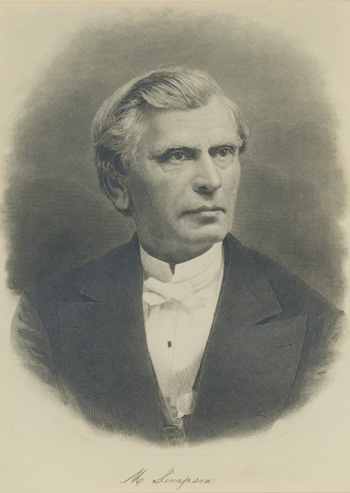

The Legacy of Matthew Simpson

Born on the Ohio frontier to parents who sold and traded weavers' reeds, Matthew Simpson went on to become a medical doctor and one of the most inspirational religious leaders of his day. In 1852, Simpson was elected as an American Bishop of the Methodist Episcopal Church.

Bishop Simpson was an influential leader and friend of President Abraham Lincoln. He contributed greatly to Lincoln's Emancipation Proclamation and delivered the eulogy at Lincoln's funeral. Because of Simpson's eloquence and extraordinary impact, Indianola citizens honored him in naming Simpson College.

When Bishop Simpson died in 1884, just shy of his seventy-third birthday, he left a wealthy and significant legacy. His daughters, Ida and Elizabeth, deeded part of the estate—commercial property in Pittsburgh—to Simpson College in 1937. The value of this property was $300,000, a virtual fortune during The Great Depression. That gift was placed into the College's endowment—the spendable earnings still support faculty, provide student financial assistance, and fund academic programming.

In honor of Matthew Simpson, his family, and the incredible impact his legacy had on Simpson College, the Board of Trustees established The Matthew Simpson Society in 1988. The society recognizes alumni and friends who provide estate gifts to Simpson College.

Leave Your Legacy—Membership in The Matthew Simpson Society

When you make an estate commitment to Simpson College through your will, an annuity, unitrust, or life insurance policy, you are recognized as a member of The Matthew Simpson Society.

The Advantages

Deferred and estate gifts have advantages that make them attractive to many donors. You can take full advantage of your resources throughout your life, then upon death, your donation to Simpson College is paid through your estate. Many are able to make larger donations this way. You also pay no estate tax on your gift to Simpson College.

Depending on your age, amount contributed, and type of property given, a deferred gift can result in significant tax deductions, lifetime income, and perhaps partially or totally tax-free income.

You may use your planned gift as a naming gift to honor or recognize a family member, friend, or yourself. Naming gifts are placed in the endowment and are used to name a scholarship, faculty chair, or special departmental fund at your direction.

Deferred gifts can be made using most types of property. Cash, retirement accounts, stocks, bonds, land, and real estate are examples. It is even possible to donate your home to Simpson College, receive a sizable tax deduction for your gift and continue to live in your home for as long as you wish.

If you want to be recognized as a member of The Matthew Simpson Society, or wish to benefit from planning a deferred or estate gift to Simpson College, please contact me at the Office of College Advancement.

Chris Goodale '86

Office of College Advancement

Simpson College

701 North C

Indianola, Iowa 50125

515-770-1426

chris.goodale@simpson.edu

The great colleges of tomorrow are being strengthened by individuals who plan future gifts today.

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results. California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.